5 Best Books on Forex Trading for Beginners

Contents

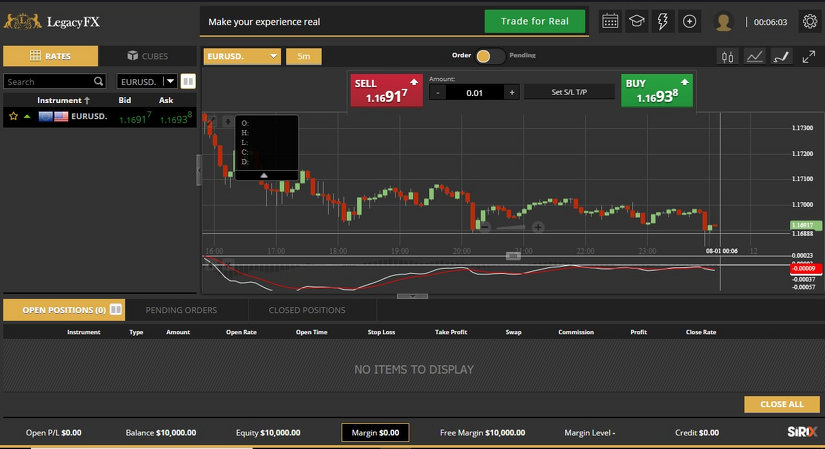

Brokers will sometimes offer free access to advanced trading tools, one-on-one training, VPS services or personalised customer support with higher minimum deposits. Beginners will also appreciate Capital.com’s low fees and excellent customer support. Capital.com’s trading fees are very low, with spreads starting at 0.6 pips on the EUR/USD, and a low minimum deposit of 20 USD, making it accessible to new traders.

While it’s a pretty short read, it provides a clear breakdown of the general terms and ideas surrounding forex markets. The downfall of learning forex trading with a demo account alone is that you don’t get to experience what it’s like to have your hard-earned money on the line. Trading instructors often recommend that you open a micro forex trading account, or an account with a variable-trade-size forex grid trading strategy broker, that will allow you to make small trades. Spend some time reading up on how forex trading works, making forex trades, active forex trading times, and managing risk, for starters. There are plenty of websites, books, and other resources you can take advantage of to learn more about forex trading. Learn about the global FX market, currency pairs and how a trade works.

This will allow you to calculate how much a movement of one pip will increase or decrease your portfolio value. While there are currently 180 government issued currencies used across the world, the majority of forex traders focus on only about a half dozen of them. What’s more, nine times out of ten, the US dollar is one half of the pair, which makes remembering the most commonly traded pairs pretty easy. As you can imagine, the smaller the spread, the better for the trader. The size of the spread you are offered will depend on a lot of things, including the overall demand for the currency, its volatility, and its liquidity. This is why spreads are usually pretty tight in the forex market, it’s all liquid.

As such, the forex market can be extremely active anytime, with price quotes changing constantly. Voted Best Forex Trading App by theGlobal Forex Awards, AvatradeGO allows access to trader insights, connect with global trading markets, create watchlists, and view live prices and charts. It also offers a range of trading tools, including Autochartist, Duplitrade, and AvaProtect, its own state-of-the-art risk management system. Lastly, Avatrade’s educational and market analysis materials are comprehensive, well-structured, and in-depth, catering to traders of all experience levels.

International currencies need to be exchanged to conduct foreign trade and business. Some traders might find day trading suitable for them, but then change to swing trading later in their trading career. Just as the market environment constantly evolves, so do traders and their preferences.

Use a Micro Forex Account

It’s unlikely you’ll ever get to explore them all if you’re working for a company. FX currencies allow for trade on every level, from the small town marketplace to international trade agreements. Here you can find out more about the various features of CFDs and how they work. This is done for several reasons, but an easy example can be seen in the commodities market when an airline company needs to secure that it has enough fuel six months from now. If oil prices are low, they may sign a futures contract, committing to pay today’s oil price 6 months down the line.

Central banks determine monetary policy, which means they control things like money supply and interest rates. The tools and policy types used will ultimately affect the supply and demand of their currencies. A government’s use of fiscal policy through spending or taxes to grow or slow the economy may also affect exchange rates. Cross currency pairs, known as crosses, do not include the US Dollar. Historically, these pairs were converted first into USD and then into the desired currency – but are now offered for direct exchange.

Regulation ensures the security of your funds and offers protection against broker bankruptcy and also ensures that Forex traders have a complaint channel and access to investor insurance. XTB provides some of the best training materials available for beginners. Its Trading Academy is comprehensive, clear and concise, and structured like a course. It also offers one-on-one mentoring, dedicated account management, and 24/7 customer service allowing a smooth onboarding experience for beginner traders. The main thing to pay attention to in this case is the size of the spread.

I welcome you to read on and learn three trading strategies that have become staples in my trading plan. The challenge starts in figuring out when to enter or exit a trade. The key to prevent losses in day trading is to develop a process. Seasoned day traders usually follow a systematic approach to day trading.

Stock Market Investing for Beginners and Forex Trading

Bworld is a customer-oriented, dedicated company, determined to aid in advancing our clients and help them become the best traders that they can be. involves holding positions over long-term periods and ignoring short-term price fluctuations. Position trading may be best suited to traders who spend more time understanding market fundamentals, and less time undertaking technical analysis or executing trades. Swing trading forex may be best suited to traders who prefer a balance between fundamental and technical analysis. Positions are open for several days, with the aim to buy at ‘swing lows’ and sell at ‘swing highs’, or vice versa if going short. Less time is spent analysing market trends in this method over some others, and there will be overnight holding costs and more chance of the market ‘gapping’.

So it’s no surprise the US dollar is evident in many of the ‘majors’ , which make up 75% of all forex market trades. As a beginner, it may be wise to trade the majors, as they’re known to be the most liquid and least volatile of the currency pairs. Line charts are used to identify big-picture trends for a currency. They are the most basic and common type of chart used by forex traders.

What pips mean?

‘Pip’ is an acronym for percentage in point or price interest point. A pip is the smallest whole unit price move that an exchange rate can make, based on forex market convention. Most currency pairs are priced out to four decimal places and a single pip is in the last (fourth) decimal place.

Forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. Here are some steps to get yourself started on the forex trading journey. Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among other reasons. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win.

Range trading strategy

This industry is full of paradoxes and retail traders instructed to do exactly what they are supposed to. Day trading is a great option to gain your financial freedom in a short time. You may desire to discover a part-time trading position if you’re looking to make additional money without devoting to trading full-time.

They look at the fresh news and try to determine what could happen in the market based on a new event in the world. People sometimes call it news Forex trading because it relies on fresh news so much. Beginners and veterans usually calculate how much they can deposit and not be too affected fxoptimax if they don’t get any payout from it. All of these may look overwhelming, but beginners usually take it step-by-step so that the learning material is always easy to handle. The My Trading Skills Community is a social network, charting package and information hub for traders.

Money flows

In most cases, traders find success stories from all over the world and try to include some of the used strategies in their own methods. However, this could prove very risky, simply because most success stories are about people risking quite a lot and getting lucky in the market. The aim of technical analysis is to interpret patterns seen in charts that will help you find the right time and price level to both enter and exit the market.

Can I trade without a broker in forex?

You can never completely remove the middleman but you can exchange currencies offline or through banking apps, taking part in the same exchange. You can, for example, go to your local bank and convert South African Rands (ZAR) for Euros, US dollars, and other currencies.

Forex trading is exchanging one currency for another currency to profit from the change in the exchange rate.This is known as buying and selling currency pairs. The Forex market is the largest financial market in the world, with an average daily value of 6.6 trillion US dollars . The book describes common mistakes beginner traders make and how to avoid them.

The foreign exchange market

The spot market is where currencies are bought and sold based on their trading price. It is a bilateral transaction in which one party delivers an agreed-upon currency amount to the counterparty and receives a specified amount of another currency at the agreed-upon exchange rate value. Although the spot market is commonly known as one that deals with transactions in the present , these trades actually take two days for settlement. Japanese candlestick charts are a form of technical analysis used by forex traders for speculation, equities, and hedging. For novice traders who want to know more about forex candlestick patterns, Steve Nison’s best-selling book is a good title to start with.

If you are a newbie in this field, the first thing you should do is learn about the foreign exchange market and how it works. Don’t get attracted only by the glamorous lifestyles of people who have succeeded in it. It’s a fast-changing financial trading avenue, and it’s always wise to know about the downside of it. This book will explain the size, opportunities, and current players in the market. You will be able to predict the market and the changing currency values only when you are well aware of all the economic factors that influence these things.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. Before making any decisions in relation to a financial product, you should obtain and consider our Disclosure Statement available on our website and seek independent advice if necessary. Buying a currency pair means one is speculating in the base currency appreciating in value against counter currency.

Hence, they tend to be less volatile than other markets, such as real estate. The volatility of a particular currency is a function of multiple factors, such as the politics and economics of its country. Therefore, events like economic instability in the form of a payment default or imbalance in trading relationships with another currency can result in significant volatility. Trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their interconnectedness to grasp the fundamentals that drive currency values.

It’s important to understand that both profits and losses are magnified when trading on leverage. Continue reading to discover forex trading strategies that work and gain some insights into what you need to do as a beginner trader to be successful in the forex market. But first, understand exactly what a forex trading strategy is and how to choose the right one for you. IC Markets is a well-regulated ECN broker that provides a welcoming environment for beginner traders. Many other ECN brokers fail to provide education and analysis materials, forcing traders to self-educate with third-party material. Instructional videos are also available to help clients set up trading software.

You can then see that the forex market is active almost any time of the day with the constantly changing price quotes. The market is also opened 24 hours a day, five days a week, and almost every brokerage firm offers its services during this time period. There are some things that everyone should know before entering this vast market. Before placing a trade, ensure you have followed your strategy which should include risk management. A pip is the smallest price increment tabulated by currency markets to establish the price of a currency pair. A spot exchange rate is the rate for a foreign exchange transaction for immediate delivery.

As soon as the 4 hour bar closed below support, we could have looked for an entry on a retest of former support, which came just a few hours later. Notice how USDJPY was coming off of a very strong rally when it formed the inside bar on the chart above. These are the best inside bars to stochastic strategy trade because it shows a true consolidation period which often leads to a continuation of the major trend, which in this case is up. Notice how the bar preceding the inside bar is much larger in size. This bar is called the “mother bar” because it completely engulfs the inside bar.

Additionally, the size of the market also acts as an obstacle, making it impossible even for the large players such as the central bank to manipulate the currency prices. It boasts a fast-paced market that sees trades being completed left and right without the hassle of needing to meet each other in person. The forex market is the “place” where currencies are being traded. Even though they are the most liquid markets in the world, forex trades are much more volatile than regular markets. The forex market is more decentralized than traditional stock or bond markets. There is no centralized exchange that dominates currency trade operations, and the potential for manipulation—through insider information about a company or stock—is lower.

In other words, I want you to develop a trading strategy around swing trading if that’s the methodology that resonates with you, and the one you’ve done the research on. Learn about technical analysis where you have tools like chart patterns, candlestick patterns, support & resistance, and trendlines. Study others’ systems, study everything that you can get your hands on. In today’s episode, you’ll discover a simple framework in forex for beginners to help you get in your Forex trading journey. Equity markets, interest rates and important news developments also have a role to play in determining a currency’s strength or weakness.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The currency forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well. Market analysis and research is the other cornerstone of Forex education. For traders with a solid understanding of how Forex trading works, market analysis will be the next step to profitable trading.

By trying the strategy in a real environment, rather than a demo account always helps in remembering the result. FOREX.com is a worldwide leader in currency trading and offers competitive pricing, great customer service and helpful guides and tutorials so you have a wide range of tools to start forex trading. Learning to trade as a beginner has become much easier and more accessible than ever before. FXTM has many educational resources available to help you understand the forex market, from tutorials to webinars.