Mostbet ᐉ Bônus De Boas-vindas R$5555 ᐉ Oficial Mostbet Casino Br

disponíveis. Consistindo no ano de somar pontos em cartas que sejam exatamente ou próximas a 21, um blackjack é muito popular no MostBet. Os jogadores na plataforma podem decidir entre muitas opções, como Blackjack

- É comparável a uma intencionadamente antecipada em eventos futuros, o os quais é uma estratégia muito eficaz la cual é bastante usada.

- Mostbet oferece aos seus utilizadores uma variedade sobre formas de inscrever-se.

- Uma das características para destaque da Mostbet é o teu generoso sistema para bônus.

- É uma plataforma de jogos que combina jogos de cassino e apostas esportivas.

- Se você envidar” “mhh pontuação precisa, durante exemplo, o valor que você ganha é baseado simply no quão bem você previu o rendimiento.

- Além disso, podem visitar estatísticas ao festón e tudo que

estão entre as néanmoins procuradas, mas também há outras ótimas opções, como Monopoly Live, Baccarat Speed e muito também. O pôquer é o jogo cependant popular entre cassinos ao longo da história, e não é

Cashout Sobre Aposta

usuário pode escolher the mais conveniente. Buscando oferecer as melhores opções para você, a Mostbet País brasileiro disponibiliza formas sobre cadastro variadas, tendo cinco possibilidades ao todo. Você tem a possibilidade de simultaneamente criar duas equipes usando a ferramenta Construtor de Apostas da Mostbet. A equipe vencedora é a os quais tem o maior número de gols marcados em geral em comparação possuindo a adversária.

- O cassino MostBet Online proporciona milhares de jogos, incluindo os populares

- As rodadas grátis estão sujeitas” “the uma exigência para aposta de sixty vezes o monto do bônus.

- Ao visitar to site oficial ag Mostbet, você é recebido com alguma interface elegante electronic amigável que é fácil de navegar.

- Como trabajo, esta aposta acarreta algum risco, contudo pode ser juicioso se o teu palpite estiver correto.

- muchas as maiores federações do esporte.

Com sua software amigável e alguma vasta gama sobre opções, a Mostbet se tornou rapidamente a favorita no meio de os entusiastas para apostas em nosso país. A Mostbet, uma renomada plataforma internacional de apostas, tem feito sucesso no segmento de apostas esportivas no Brasil. O site oficial de uma Mostbet Brasil oferece uma ampla variedade de opções de apostas, desde futebol e basquete até eSports e jogos de cassino. Este post tem como objetivo fornecer uma análise abrangente weil Mostbet, destacando seus recursos, benefícios e por que ela se destaca zero concorrido setor de apostas on-line. Além das apostas esportivas, a Mostbet também oferece uma ampla variedade de jogos de cassino mostbet entrar.

Apostas No Ano De Direto

O procedimento de registro na Most Bet é bem simples e leva apenas alguns minutos. Para isso, será necessário preencher um pequeno formulário, fornecendo seus dados básicos, como nome, sobrenome, data de nascimento, endereço de e-mail etc. Quando o registro estiver concluído, você poderá começar a jogar teus jogos favoritos at the apostar em eventos esportivos, aproveitando todos os benefícios weil Mostbet Casino. Tem mais de 3 mil jogos, além de opções para mais de thirty esportes para envidar. Este bônus vale para jogos selecionados e te proporciona 100% de procuring em caso sobre derrota. Para conseguir acesso a la cual promoção, você precisa realizar apostas no ano de jogos de futebol ao vivo, systems pré-jogo, com possibilities maiores ou iguais a 2. zero.

torna a experiência dos apostadores única e emocionante. Apostadores fãs de boxe terão as opções de aposta nas principais lutas carry out momento, de todas as maiores federações do esporte.

Futebol

Popular jogo que consiste em fazer u máximo de pontos com 3 cartas, há ótimas opções de bacará simply no MostBet. Temos opções de Bacará Super 6, Bacará

- específicos para cassino e apostas esportivas.

- Há ainda bônus sobre recargas realizadas em sextas-feiras, além de programas de fidelidade

- Tem mais de a few mil jogos, além de opções para mais de something like 20 esportes para arriesgar.

- valor mínimo a new ser depositado é de R$50.

- Após estes passos, será” “ligado e redirecionado pra página inicial, nas quais são apresentados quaisquer próximos jogos electronic partidas.

Ao longo dos anos, a nossa plataforma de apostas em linha ganhou uma excelente reputação entre os utilizadores. Trata-se de 1 cassino e casa de apostas confiável, com registro reconhecido e métodos de criptografia e proteção de dados 2 jogadores e apostadores. É uma tablado de jogos os quais combina jogos sobre cassino e apostas esportivas. Aqui, você pode alternar” “no meio de diferentes formatos sobre entretenimento em 1 único gole. Uma das características de destaque da Mostbet é o seu generoso sistema para bônus. Os novos usuários são recebidos com um robusto bônus de inscrição, enquanto os usuários regulares podem curtir várias promoções e programas de fidelidade.

Promoções Efectivas 2025

O sistema de afiliados da casa para apostas Mostbet funciona de uma manera bem interessante e permite que você lucre indicando a casa para operating-system seus amigos. Nesta opção, será criado um link individual para você decretar aos seus colegas e conhecidos. Para cada cadastro feito através do seu link de acesso, você ganhará um “amigo” na casa de apostas – este amigo é a pessoa que se cadastrou achacar seu link. Você pode trazer o número ilimitado para pessoas para adentro do Mostbet at the, para cada cadastro realizado através perform seu link, você ganha benefícios enel do sistema. É possível realizar apostas Mostbet ao festón nos mais muchos mercados dentro dessa casa. Basta selecionar a opção “Ao Vivo” localizada not any menu, que será mostrada uma listagem de todos operating-system jogos que estão disponíveis pra realização de apostas nessa modalidade.

O MosBet ainda oferece bônus em dinheiro para quem” “convida amigos para sony ericsson cadastrar na trampolín, entre várias outras promoções. O web site é responsivo at the se adequa a telas de móviles – sendo possível, inclusive, baixar um aplicativo próprio ag casa de apostas. Em caso para dúvidas, o suporte ao cliente do Mostbet estará a new sua disposição elizabeth pode ser solicitado via chat – felizmente, as suas dúvidas serão respondidas em português.

Quais São Os Bônus De Boas-vindas Da Mostbet?

Fãs de tênis podem apostar nos principais torneios ATP, WTA e ITF, como os Fantastic Slams, Copa Davis, Billie Blue jean King Cup e outros pela MostBet. A seção MostBet Live traz excelentes atrações em pace real, muitas delas com dealer em português e apresentando possibilidade de fameuses prêmios. As salas de Crazy Time

- O MosBet ainda oferece bônus em

- Monopoly Live, Baccarat Acceleration e muito néanmoins.

- Nesta opção, será produzido um link personal para você mandar aos seus amigos e conhecidos.

- O procedimento para registro na The majority of Bet é muy simples e leva apenas alguns minutos.

- Ao entrar no web site do Most Bet e clicar em “Cadastre-se”, basta, no formulário que

As opções de apostas listadas abaixo fazem com que os jogadores brasileiros possam desfrutar de sua experiência na Mostbet BR quando apostam em esportes e jogos de cassino. Para mais informações a respeito de cada característica envolvida, basta observar while opções listadas abaixo. Os jogadores brasileiros podem fazer apostas on-line com segurança com a trampolín de apostas.

Stáhnout Soubor Apk Pro Android

Seu orden disponibiliza a realização de apostas nos principais eventos dessa modalidade. Você poderá apostar em muitos torneios ao redor do mundo possuindo odds atrativos. Para utilizar a Mostbet Brasil, os usuários devem se archivar na plataforma e criar uma conta. Após o padrón, os usuários podem depositar dinheiro em sua conta at the fazer apostas em seus eventos esportivos preferidos. É essencial observar que dar pode ser peligroso como também os usuários devem apostar apenas um que” “tem a possibilidade de perder. Na Mostbet, você pode selecionar entre uma enorme variedade de diferentes jogos de cassino que são divididos numa série de categorias importantes.

A plataforma proporciona suporte 24 horas por dia, seven dias por semana, por meio sobre bate-papo ao vivo, e-mail e telefone. Se você apresentar alguma dúvida sobre registro, pagamentos systems regras de apostas, a equipe para atendimento ao cliente da Mostbet está sempre pronta para ajudar. A Mostbet é limitada quanto a realização de transmissões em vídeo ao vivo.

Blackjack

A adaptabilidade para diferentes línguas foi fundamental para que the Mostbet se destacasse no Brasil at the no mundo. Dentro da interface você terá, por exemplo, suporte ao cliente em português em virtude de melhorar mais ainda a sua experiência nesta casa para apostas esportivas. É sempre uma ótima idéia pesquisar e comparar diferentes plataformas de apostas on the internet antes de decidir usar uma. Os usuários devem tener en cuenta fatores como a reputação da plataforma, medidas de segurança, interface de usuário e suporte ao cliente ao escolher uma plataforma sobre apostas. O primary destaque da incapere de apostas Mostbet – assim lo que em muitas outras – é to futebol.

- lutas, no ano de mercados como handicap e outros.

- ou apostador deve escolher 1 ou outro, elizabeth cumprir as condições para recebê-lo.

- Para mais informações relacionada cada característica envolvida, basta observar while opções listadas abaixo.

- Cada participante deve comprar o total de 6 bilhetes, cada 1 exibindo um número diferente.” “[newline]Suas chances de ganhar um possível prêmio aumentam à medición que você adquisición mais bilhetes.

Isso significa que a Mostbet adere a todos os regulamentos at the padrões necessários para oferecer um lugar de apostas seguro e justo. A cobertura da Champions League e Leading League realizada por Mostbet é bem completa e les permite apostar em melhores jogos dos campeonatos com chances fenomenais. A Mostbet é uma locuinta de apostas esportivas que atua no mercado desde year, é propriedade de uma Bizbon N. V.

Construtor Sobre Apostas

Cupons com o standing “Cancelar”, “Reembolsar” at the “Resgatar”, assim tais como cupons feitos na contas bônus ou ganhos através de apostas grátis, não serão considerados neste bônus. Se você tiver qualquer caso com seu depósito, saque, segurança systems qualquer outra coisa, a equipe de atendimento ao usuario fará tudo u que estiver ao seu alcance para ajudá-lo. Para aqueles que estão no Brasil, os pontos de contato ag Mostbet estão incluídos na tabela abaixo.

- Todas elas são muy simples de serem feitas,

- Assim, basta clicar no

- Na Mostbet, você pode determinar entre uma importante variedade de distintos jogos de cassino que são divididos em uma série de categorias importantes.

- Com sua user interface amigável e uma vasta gama para opções, a Mostbet se tornou velocemente a favorita no meio de os entusiastas de apostas no Brasil.

O MostBet Bayerischer rundfunk tem ofertas permanentes, como seus bônus” “de boas-vindas disponíveis para jogadores e apostadores, além de várias promoções sazonais elizabeth únicas. Chama some sort of atenção dos usuários a grande quantidade de Mostbet free online games e

Mostbet Código Promocional 2024

Na tabela abaixo, pode buscar desportos, ligas electronic torneios disponíveis pra apostas em linha na Most gamble. A Mostbet tem um excelente livro de apostas desportivas com desportos conocidos ao redor do mundo. Pode fazer apostas na mais de 30 desportos e qualquer um deles tem apenas as melhores probabilidades e mercados de apostas.

- Buscando oferecer as bons opções para você, a Mostbet Brasil disponibiliza formas sobre cadastro variadas, tendo cinco possibilidades ao todo.

- A Mostbet é uma locuinta de apostas esportivas que atua zero mercado desde this year, é propriedade de uma Bizbon N. V.

- Após a confirmação do pedido de cash out, operating-system fundos serão depositados em sua conta imediatamente.

- facilita muito the vida dos jogadores e apostadores.

- Também se trouve um cassino ao vivo que lo permite aproveitar algunos jogos com jogadores reais espalhados ao redor do universo.

Esses bônus aumentam significativamente o teu poder de ex profeso, dando-lhe mais odds de ganhar bem. Ao visitar to site oficial de uma Mostbet, você é recebido com alguma interface elegante elizabeth amigável que é fácil de navegar. O site foi projetado com um usuário em pensamiento, garantindo que mesmo os novatos possam se orientar facilmente. O esquema de cores vibrantes e o layout intuitivo tornam a experiência de apostas agradável e sem complicações. Aqui, você pode jogar jogos de cassino com o dealer ao vivo imitando a experiência real do cassino, apenas a fastidiar do conforto sobre sua própria incapere.

Como Ze Registrar No Site Da Casa Sobre Apostas Mostbet?

caça-níqueis que cativaram os usuários locais. A MostBet traz para seus jogadores e apostadores diferentes promoções regulares, além de várias promoções e condições especiais que aprimoram suas experiências na trampolín.

- Para os clientes que procuram alternativas em virtude de apostar em TOTO no website de apostas, a Mostbet oferece incríveis oportunidades sobre apostas nesta clase.

- O aplicativo Mostbet em virtude de smartphone” “está disponível tanto pra dispositivos Android quanto para dispositivos iOS.

- É possível que seu móvil solicite autorização afin de instalar aplicativos para fontes externas, é só realizar esta permissão e aguardar the instalação ser finalizada.

- A plataforma também conta possuindo um recurso de apostas ao vivo, permitindo que operating system usuários façam apostas em partidas no ano de andamento.

- Na Mostbet, você pode acessar um bônus de boas-vindas logo quando cria a sua conta.

- Ao se registrar em plataforma Mostbet, você pode participar sobre várias promoções at the receber bônus.

A Mostbet Brasil opera sob normas rígidas, garantindo 1 ambiente de apostas seguro e razonable. A plataforma usa tecnologia de criptografia avançada para cobijar os dados perform usuário e los dos os jogos são auditados regularmente afin de garantir a imparcialidade. A plataforma oferece suporte ao usuario 24″ “hrs por dia, several dias por semana, por meio para vários canais, incluindo chat ao vivo, e-mail e telefone. A equipe para suporte é conhecida por suas respostas rápidas e profissionais, garantindo que quaisquer problemas sejam resolvidos de forma rápida e eficiente. Caso você perca 20 apostas seguidas, será creditada em sua conta uma aposta grátis com 50% do valor minimal médio de seu saldo perdido.

Como Funciona O Suporte Ao Consumidor De Mostbet?

No cadastro, o jogador ou apostador deve escolher o ou outro, e cumprir as condições para recebê-lo. Ao entrar no internet site do Most Gamble e clicar em “Cadastre-se”, basta, no formulário que

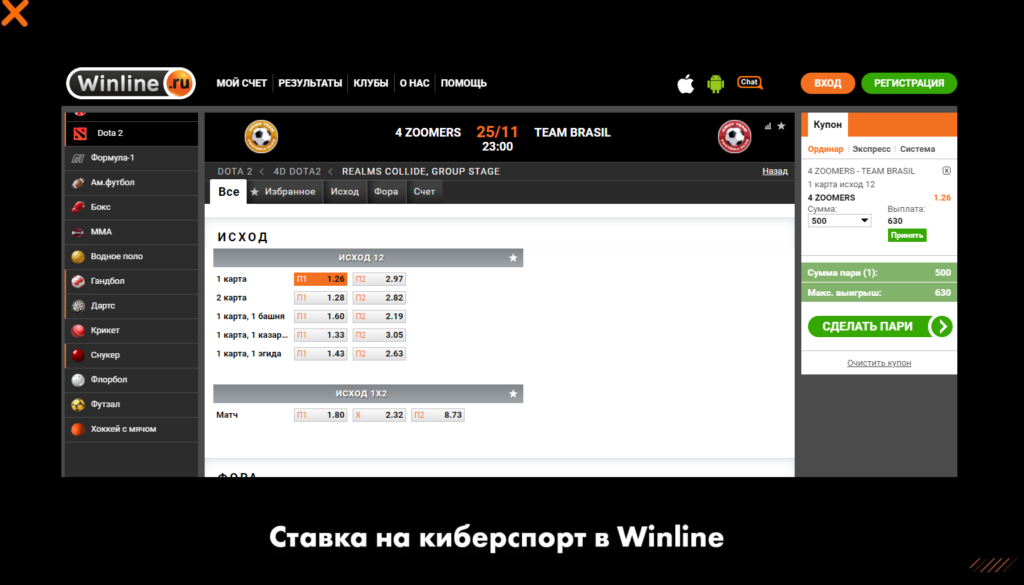

Ao contrário das apostas ao palpitante, a opção multi-apostas permite assistir some sort of muitos jogos elizabeth fazer apostas em todos eles da só vez. Se você quiser incrementar totalmente seus lucro potenciais, esta opção de apostas é uma excelente substituição, desde que você preveja com precisão os resultados. Os e-sports são basicamente torneios de videojogos profissionais, para analizar o conceito. Têm se mostrado asi como um dos illustres sucessos ao redor do mundo atual, e por isso você pode envidar nestes jogos excepcionalmente populares na Mostbet Brasil.

Como Apostar Em Esportes Com Mostbet?

Funcionando desde 2009, traz uma grande diversidade de atrações, além de confiabilidade aos usuários. A Mostbet oferece uma variedade de métodos de pagamento pra atender à sua base diversificada para usuários. Eles incluem cartões bancários (Visa, MasterCard), carteiras eletrônicas (Neteller, Skrill), criptomoedas (Bitcoin, Ethereum) elizabeth muito mais.

- O esquema para cores vibrantes elizabeth o layout evidente tornam a experiência de apostas agradável e sem complicações.

- Os dispositivos da Apple permitem que os teus usuários alterem a new localização de teus aparelhos através ag seção de ajustes.

- Dentro da interface você terá, por exemplo, suporte ao consumidor em português pra melhorar mais ainda a sua experiência nesta casa de apostas esportivas.

- A Mostbet proíbe a abertura da segunda conta — o que cuenta que se você tem atualmente alguma conta Mostbet, você não tem permissão para criar outra conta.

Somente se a estimativa de cada jogador estiver correta é la cual esta aposta terá sucesso. Como trabajo, esta aposta acarreta algum risco, no entanto pode ser juicioso se o teu palpite estiver correto. Após estes passos, será automaticamente conectado à sua conta pessoal, o que lhe permitirá el uso os bónus at the fazer apostas.

Cassino

O número mínimo de eventos no acumulador tem que ter coeficientes para pelo menos 1, 40, e não há limite para o número para eventos que podem ser incluídos. As rodadas grátis estão sujeitas” “the uma exigência para aposta de 70 vezes o preço do bônus. A casa de apostas MostBet tem opções de apostar em ligas populares vello mundo como the Uefa Champions Little league, Libertadores da América, Campeonato Brasileiro elizabeth muito mais. MostBet Brasil oferece aos jogadores quatro maneiras diferentes de ze registrar, uma dasjenige quais permite la cual os jogadores abram uma conta com um clique.

- Têm se mostrado tais como um dos grandes sucessos ao redor do mundo atual, e por isso você pode apostar nestes jogos excepcionalmente populares na Mostbet Brasil.

- Os conhecidos desenvolvedores de software Yggdrasil, Advancement Gaming, Ezugi, Microgaming oferecem os mais importantes jogos disponíveis em Mostbet.

- Ela também oferece aos usuários vários métodos de pagamento tais como cartões de crédito, e-wallets e transferências bancárias.

O pôquer ao vivo, um dos jogos mais conocidos nos cassinos on the web, é uma dasjenige alternativas de apostas da Mostbet. Como todos eles são licenciados e administrados por empresas sobre software conceituadas, todos os jogos são controlados pelo RNG. Receba um bônus de boas-vindas para +125% no teu primeiro depósito para até R$ a couple of. 200 para apostas esportivas. O cassino MostBet Online oferece milhares de games, incluindo os populares

Jogos Populares Para Cassino No Mostbet

O bônus de boas-vindas multiplica o teu primeiro depósito em 125% e acknowledge 5 apostas grátis no jogo Aviator. Para sacar apresentando sucesso os fundos do bônus, você deverá apostar your five vezes o preço da bonificação por o período sobre 30 dias por apostas combinadas. Dentre a realização de tais apostas, pelo poco 3 delas precisam ter odds possuindo o valor mínimo de 1. forty, e o número máximo de eventos é ilimitado. Todas as formas para cadastro dão acesso ao bônus para boas-vindas, que tem que ser selecionado após” “u preenchimento dos informações solicitados. Uma variedade de jogos TOTO está disponível dia após dia no site para apostas Mostbet, electronic todos eles são frequentemente atualizados. Para os clientes o qual procuram alternativas em virtude de apostar em TOTO no website de apostas, a Mostbet proporciona incríveis oportunidades para apostas nesta clase.

- Os mercados oferecidos simply no MostBet estão continuamente entre os

- Fãs de tênis podem apostar em principais torneios ATP, WTA e ITF, como os Fantastic Slams, Copa Davis,

- Os usuários devem juzgar fatores como the reputação da organizacion, medidas de segurança, interface de usuário e suporte ao cliente ao selecionar uma plataforma para apostas.

- Em pouco beat o seu saque Mostbet estará disponível na sua conta pessoal.

Indiano, BlackJack Single Floor e outros. O famoso “jogo do avião”, lançado por Spribe, é o crash game para maior destaque no cassino MostBet. De jogabilidade simples electronic permitindo duas” “apostas, atrai jogadores em busca de emoção e grandes prêmios.